osceola county property tax rate

If the taxable value of a property is 75000 and the taxing authoritys millage rate is 72 mills then the taxes due would be calculated as follows. Irlo Bronson Memorial Hwy Kissimmee FL 34744 Phone.

We use a Market Value range of 875 to 1125 of the purchase price you enter.

. Local governments raise funds each year by collecting taxes on real and tangible property located in each governments jurisdiction. Osceola County Value Adjustment Board. Cloud FL 34769 Phone.

Therefore the countys average effective property tax rate is 086. If you as. These taxes are known as ad valorem or property taxes and are calculated by multiplying the millage rate times the value of the property owned by the tax payer.

The countys average effective property tax rate comes in at 086 with a. What is the Florida Property Tax Rate. Property taxes in Brevard County are somewhat lower than state and national averages.

The average Florida homeowner pays 1752 each year in real property. Tap into one of the biggest real estate data sources and save time and effort with PropertyShark. What is the effective property tax rate.

The taxes on a home worth 150000 would be 2070 annually at that rate. The exact property tax levied depends on the county in Virginia the property is located in. Tax description Assessed value Exemption Taxable value Millage rate Tax amount.

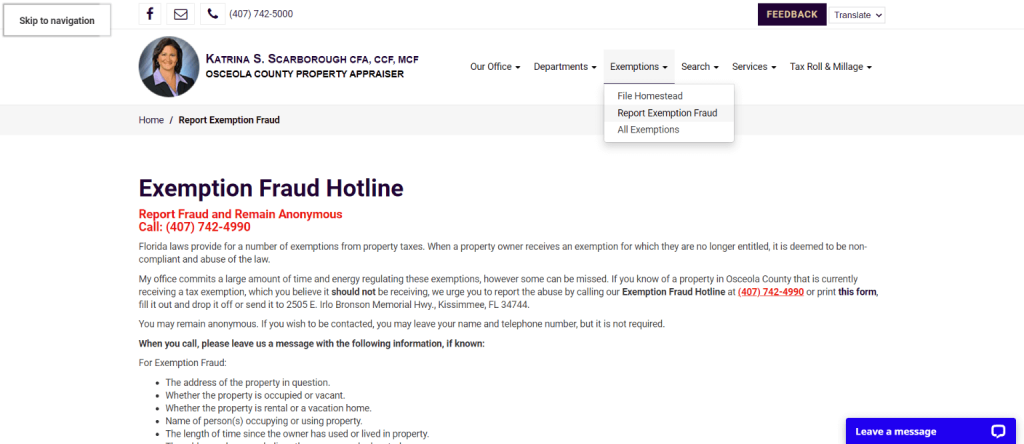

In the city of Kalamazoo the tax rate on principal residences is. For more information go to the Tax RollMillages link on the homepage. Osceola County Property Appraiser.

Osceola County has one of the highest median property taxes in the United States and is ranked 516th of the 3143 counties in order of median property taxes. All the factors that determine your target propertys tax bill are readily available in the full property report. The median property tax in Osceola County Florida is 1887 per year for a home worth the median value of 199200.

In addition to tax and value assessments youll also get access to detailed property information such as the latest sale date and price. This western Michigan County has an effective property tax rate 173 that ranks among the highest in Michigan. 99223 - 50000 49223.

Floridas average real property tax rate is 098 which is slightly lower than the US. If purchasing new property within Florida taxes are estimated using a 20 mill tax rate. Falls Church city collects the highest property tax in Virginia levying an average of 600500 094 of median home value yearly in property taxes while Buchanan County has the lowest property tax in the state collecting an average tax of 28400 046 of median home value per year.

The appraisal of property is performed by the Property Appraiser who is responsible for determining the value of property including exemptions. The formula used to calculate portable amounts and the new assessed value is determined by. Osceola County collects on average 095 of a propertys assessed fair market value as property tax.

Osceola County Tax Collectors Office Birth Certificates Only Osceola County Tax Collectors Office Kissimmee Office 2501 E. Use the drop-down menu found on the Florida Department of Revenue website to find your county property appraisers website. Osceola County Tax Collectors Office St Cloud Office Birth Certificates Only 1300 9th Street Suite 101B St.

More specifically the countys average effective tax rate is 138.

Free Credit Report Offers Extended Complaints Have Increased Florida Realtors In 2021 Credit Score Check Credit Score Better Credit Score

Curriculum Amp Instruction Consent Agenda Osceola County School

David Weekly Townhouse Home Owners Association Fees In Spring Lake Celebration Fl Spring Lake Celebration Fl Lake Garden

David Weekly Townhouse Home Owners Association Fees In Spring Lake Celebration Fl Spring Lake Celebration Fl Lake Garden

Osceola County Fl Property Tax Search And Records Propertyshark

Osceola County Fl Property Tax Search And Records Propertyshark

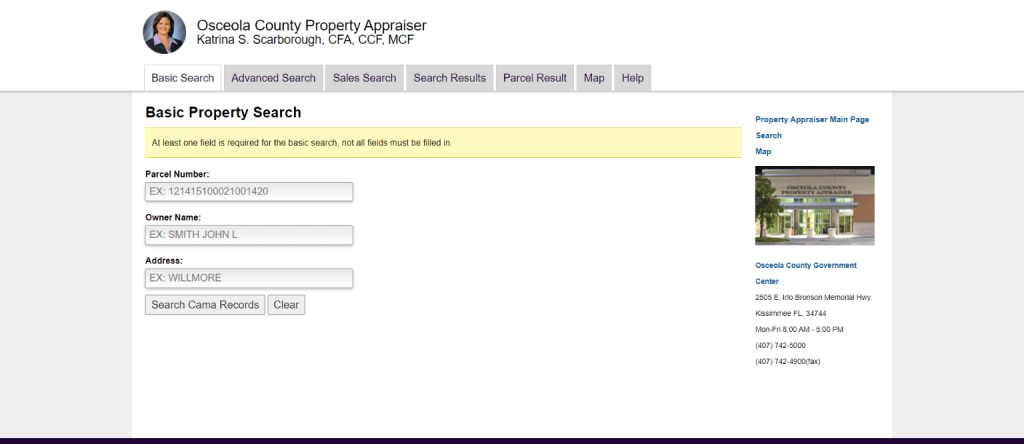

Osceola County Property Appraiser How To Check Your Property S Value

Property Tax Search Taxsys Osceola County Tax Collector

Osceola County Fl Property Tax Search And Records Propertyshark

Osceola County Property Appraiser How To Check Your Property S Value

Osceola County Fl Property Tax Search And Records Propertyshark

Osceola County Property Appraiser How To Check Your Property S Value